One day in early May, Paul Barton opened his inbox to find an email from a sender he didnÔÇÖt recognize.

The message included a virtual business card with a photo of a smiling young woman with shoulder-length hair, identified as a manager at a debt litigation law firm. Attached was a lawsuit.

He and his wife, Debra, were being sued for almost $24,000.

ÔÇťA process server will deliver this to your door,ÔÇŁ the email said.

The 68-year old grew worried. He and his wife were already struggling to buy groceries. They couldnÔÇÖt afford a lawyer.

But then it dawned on him: Barton used to be a process server, and knew lawyers generally donÔÇÖt tell people before serving them.

ÔÇťIt’s a surprise,ÔÇŁ he said. ÔÇťYou’re warning me it’s coming.

ÔÇťTo me it was all just plain scare tactics,ÔÇŁ said Barton, who, three weeks after receiving the email, still hasnÔÇÖt been served in-person.

Since late March, Canadian ╔ź╔ź└▓ Improvement Credit Corporation (CHICC) has filed nearly 100 lawsuits against Ontarians, including one targeting the Bartons.┬áIn more than 50 statements of claim reviewed by the Star, the financing company demands homeowners pay thousands of dollars for allegedly breaching contracts to rent or lease household appliances.

The contracts allowed CHICC to put a Notice of Security Interest (NOSI) against the customerÔÇÖs property, according to cases reviewed by the Star, something some homeowners say they werenÔÇÖt even aware of until they tried selling or remortgaging their home.

Ontario moved to ban NOSIs used to ÔÇśextortÔÇÖ consumers

A NOSI is a financial tool similar to a lien that the Ontario government recently introduced legislation to ban because it says they are used by ÔÇťbad actorsÔÇŁ to ÔÇťextort exorbitant payments from consumers, particularly seniors.ÔÇŁ

CHICCÔÇÖs recent lawsuits focus on customers allegedly defaulting on their contracts, with the court filings beginning just weeks after the government announced its plan to retroactively ban NOSIs.

For seniorsÔÇÖ advocates, it signals a shift in strategy to enable the company to continue to extract money from contracts they allege are predatory and unfair. Faced with looming legislation that would shut off an income stream from NOSIs, the company is using the threat of lawsuits to bully vulnerable Ontarians, including seniors, into giving over more money, advocates allege.

ÔÇťWe are concerned because this appears to be an abuse of the court process,ÔÇŁ said Bethanie Pascutto, staff litigation lawyer at Advocacy Centre for the Elderly.

Lawyer Bethanie Pascutto, from the Advocacy Centre for the Elderly, is working to help seniors targeted in a wave of lawsuits over contracts to rent or lease household appliances.

Steve Russell / ╔ź╔ź└▓ StarCompanyÔÇÖs rep says lawsuits are unrelated to looming legislation

The BartonsÔÇÖ experience with CHICC goes back to late 2021, when they needed a new furnace, water heater and thermostat for their new home in Chalk River, about 180 kilometres northwest of Ottawa.

Barton found an HVAC company online. From its name, Ontario Green Savings (OGS), he thought they were linked to the government. He signed a contract with OGS and CHICC, the financing company.

The water heater OGS installed emits the smell of gas whenever the couple uses hot water, the Bartons allege, yet no one showed up for yearly servicing of the equipment, as promised, nor addressed their concerns when they called. He was also surprised to learn that CHICC registered two different NOSIs against his home.

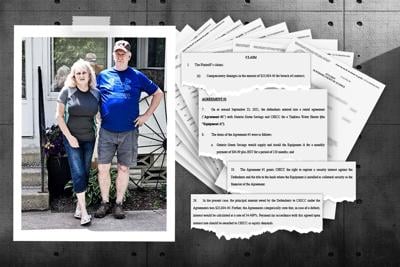

Debra and Paul Barton of Chalk River, Ont. The couple are among scores of Ontario homeowners being sued by Canadian ╔ź╔ź└▓ Improvement Credit Corporation.

Supplied by the BartonsThe couple said they stopped paying the monthly fees around February.

Michael Solomon, a paralegal and managing partner of the firm that represents both CHICC and OGS, said CHICC is acting no differently than would a credit card company that’s owed money, and the lawsuits have “absolutely nothing to do with the legislation coming down the pike.ÔÇŁ

He also encouraged the Star to stop its reporting, saying an article “hinders the court process and due process that our clients have in the court system by not allowing justice to be blind.”

“I am advising you that it is in your best interest to cease and desist with your report effective immediately,” Solomon wrote in an email. “I am certain that you are intelligent enough to understand that certain tort law exists for a reason.”

ÔÇśPredatory practicesÔÇÖ decried by judge

CHICC has a rating of F with the Better Business Bureau. The company is also listed on the provinceÔÇÖs Consumer Beware list and in November was issued a notice that there are reasonable grounds to believe CHICC is or was engaged in activity that contravenes the Consumer Protection Act. A notice is not a charge under the Act.

OGS, a company that CHICC has partnered with, was fined hundreds of thousands of dollars by the province in 2021 for unfair and misleading business practices as well as failing to deliver a valid contract and failing to refund.

Last year, a consumer won a judgment against 10392197 Canada Corp., the corporation number for the company currently operating as Ontario Green Savings. (The individual also sued CHICC, but stopped pursuing that claim after CHICC removed the NOSIs from her home, and that case was dismissed.) At the time, the numbered company was operating as Ottawa Green Savings.

ÔÇťAs a whole, (Ottawa Green Savings)ÔÇÖs conduct is reprehensible and shows contempt for the consumer protection provisions in the Act,ÔÇŁ the judge wrote.

In awarding the plaintiff $10,000, the judge said, ÔÇťI find that punitive damages are appropriate to discourage OGS, and other companies like it, from engaging in such predatory practices.ÔÇŁ

NOSI scams often target Ontario seniors

The way some businesses have abused NOSIs has been well-documented. Generally, a company uses persuasive and at times aggressive sales tactics to get homeowners to sign contracts with high interest rates. Eventually, something will go wrong ÔÇö the products prove defective, for example, or promises to service the equipment are not honoured ÔÇö and the homeowner is unsuccessful in addressing the issue with the company. Eventually, customers stop paying their bills.

But when a homeowner later tries to sell or refinance their property, theyÔÇÖre surprised to learn the company registered NOSIs without informing the customer. At that point, businesses may pressure customers to negotiate a buyout of the contract, with potentially huge payouts, says the government. In some cases, homeowners may lose their property.

These types of scams often target seniors.

In 2023, Ontario Green Savings Corp. took a number of customers to court, where the company sought to have judges validate the NOSIs and require the homeowners to pay up or hand over the title of their property.

CHICCÔÇÖs 2024 lawsuits instead focus on alleged breaches of contract. The Star learned at least one homeowner named in the lawsuits was in talks to negotiate a settlement with the company.

Reuben Rothstein, a lawyer at McMillan LLP who volunteers with Pro Bono Ontario, represented a client who was sued in 2023.┬áHe said he’s handled numerous calls involving CHICC and OGS and similar alleged schemes.

He says the case against his client was later withdrawn. That client is now suing the companies.

ÔÇťOur view is that these companies are suing people merely to scare them into making a payment they arenÔÇÖt necessarily obliged to make,ÔÇŁ said Rothstein.

ÔÇťIf that’s true, then they would have been using the justice system as part of their scheme,ÔÇŁ he continued. ÔÇťThey should not be allowed to do that with impunity.ÔÇŁ

Questions raised about latest wave of lawsuits

The province tabled the new law on May 27, which, if passed, would ban NOSIs on land titles for consumer goods, and expire existing ones.

However, the proposed law will not remove a companyÔÇÖs security interest in the equipment or void their contracts with consumers, the province said. If a consumer defaults on payment, a business may still repossess the fixture and seek repayment using other means, including the courts.

Todd McCarthy, Minister of Public and Business Service Delivery, provides remarks and holds a media availability.

Pascutto, of the Advocacy Centre for the Elderly, has several concerns with the lawsuits recently filed by CHICC. For one, they were filed in Superior Court even though most of them are for amounts less than $35,000 (excluding interest). The claims should have been brought in small claims court, she said.

ÔÇťIt is much more difficult and expensive to defend a claim in Superior Court than it is to defend a claim in small claims court,ÔÇŁ said Pascutto, noting she can’t comment on the merits of the various claims.┬á

ItÔÇÖs not known if CHICC has filed additional lawsuits in small claims court.

At least 20 of the claims involve alleged defaults that occurred more than two years ago. Usually, claims must be brought within two years of the date when a breach was discovered, Pascutto said ÔÇö in the cases of CHICCÔÇÖs lawsuits, within two years of a default.

But itÔÇÖs generally up to defendants to flag these issues, which means the Ontarians named in the cases would have to file a defence and plead their case, Pascutto said.

Pascutto said she hopes to bring these issues to the courtÔÇÖs attention, and has already sent letters to defendants noting places they can get free legal advice, such as the or . Eligible people can also contact or .

The Ministry of Public and Business Service Delivery declined to comment on the recent CHICC lawsuits, saying it would not be appropriate to comment on litigation currently before the courts.

Individuals who believe they entered a contract with a business that violates consumer protection law can have their complaints reviewed and assessed by Consumer Protection Ontario, said Matthew DÔÇÖAmico, ministry spokesperson.

ÔÇśIt’s just put so much stress on our livesÔÇÖ

Barton and his wife, Debra, say they stopped paying their monthly fees after speaking on the phone several times with someone identifying themselves as a consumer protection representative. There was a class-action lawsuit, the person told them, and the Bartons could get some of the money set aside for victims, so they would only have to pay a fraction of their monthly bill. They would also get the NOSIs removed from their house.

The person also came to the BartonsÔÇÖ home and took pictures of the fixtures. On the personÔÇÖs instructions, Barton put a stop payment.

Barton believes the NOSIs have been removed. But the couple has since stopped being able to contact the person and has yet to receive any paperwork from them. They wonder if that person was a hoax.

The Bartons are now just waiting to see what happens. At the same time, theyÔÇÖre facing mortgage renewal this summer. If itÔÇÖs not approved, theyÔÇÖll have to sell their home.

ÔÇťIt’s just put so much stress on our lives,ÔÇŁ said Debra. ÔÇťWhere do we go?ÔÇŁ

Correction ÔÇô┬áMay 31, 2024

The article incorrectly stated that Paul Barton was told that there was a class action lawsuit against CHICC. In fact, Barton says he was told it was against another firm. As well, this article was updated to clarify that Mr. Rothstein said he has handled numerous calls involving CHICC and OGS and similar alleged schemes. The article has also been updated to reflect that a Notice of Security Interest is not a lien.

To join the conversation set a first and last name in your user profile.

Sign in or register for free to join the Conversation